Manufactured Crises in Suburban Public Schools

In most of our sleepy suburban communities in western New York, school districts are run without much fuss. Once in a while you get an eruption of controversy, such as what’s been happening in Lancaster with respect to its abandonment of the “Redskins” monicker. In Lancaster, the school superintendent is now receiving death threats and police protection for him and his family. Over a mascot’s name. School is important, but not in that way. This isn’t a 3,000-word screed about the common core or testing, either. This is about how a community helps pay to educate its kids.

Municipalities and their school boards walk a delicate tightrope between taxpayer expectations and school needs. Among the suburban districts that are typically most highly ranked in Business First’s annual assessment – Williamsville, Orchard Park, Clarence, and East Aurora – they achieve that balance in difference ways. In Williamsville, the school tax rate is about $18 per $1,000 of assessed value. In Orchard Park and East Aurora, the school tax rate exceeds $30 per $1,000 of assessed home value. By contrast, Sloan’s is $57 per $1,000.

It is also typical that budget proposals in high-performing school districts don’t regularly get a lot of pushback from taxpayers. So long as results are good and money is being spent prudently, annual school budget votes proceed without much controversy. Why ruin a good thing? When real estate is bought, the school district oftentimes weighs very heavily in the decision-making. If a home is in a high-performing district, that has a positive effect on the purchase price and home value. Look at any home listing, just about anywhere.

(I hope you’ll excuse the limited geographical scope of this piece. It’s that time of year again when my free time becomes subsumed by thoughts of school budgets and election battles. Although its scope is facially narrow, the underlying points are valid for most upstate suburban and rural school districts, especially in light of Albany’s game-playing with school funding over the last several years.)

In Clarence, however, we have a different scenario altogether. Clarence’s school tax rate is $14.80 per $1,000 of assessed value – less than half that of OP or East Aurora. Clarence is lucky – it has a lot of very expensive pieces of property, so the rate doesn’t need to be as high as in other communities. Nevertheless, a small cabal of anti-school propagandists would have you believe that the district is spendthrift, bloated, and unfair to the taxpayer – that same taxpayer who relies on the schools’ excellence for her home’s resale value.

They say it’s “unsustainable”. Yet today’s $14.80 rate is almost identical to the rate in 2008 – 2009. In 2003, the rate was significantly higher – almost $17. It dropped steadily until 2011, when it slowly began to creep up from a low of $14.13, as state funding dried up and the district had to look to local taxpayers to help bear more of the burden.

What do we get for that money? Is the district spendthrift? Bloated? Not only is the answer a resounding “no”, but the district’s educational output is outstanding. Clarence is ranked 3rd out of 432 WNY districts for excellence but also for cost-effectiveness. It’s 6th in administrative efficiency, and its per-pupil spending is 2nd lowest in Erie County; it’s 6th lowest in the entire state. The school tax rate is the second lowest in WNY. By all accounts, this is a triumph of cost-effective, excellent results. It’s the sort of thing that anyone – liberal or conservative – would proudly show off as a testament to good, small government. You would think that a school district with those sorts of numbers would have no pushback from angry taxpayers.

Unfortunately, you’d be wrong.

In 2013, a perfect financial storm came about that required a proposed 9.8% tax hike to maintain then-extant staff and services. The school board took a gamble that the community had the schools’ back and would support it in a tough time. On the contrary, voters overwhelmingly rejected that proposal, sending the message that any increases in the levy should remain at or under the state’s new tax cap. That’s what the board did in the June 2013 re-vote, cutting tons of clubs, extracurriculars, sports, services, curricula, and teachers. It did so again in 2014, and there was no opposition to that at-cap budget. Meanwhile, the Clarence district alone has lost over $16 million in state aid thanks to the state legislature’s astonishingly cynical “gap elimination adjustment”, an accounting gimmick that balanced the state budget on the backs of local school districts.

Here we are in 2015, and the school board hasn’t even presented a final budget proposal, as the district tries to figure out how much state aid it’s going to receive. Yet a certain subset of local activist – as angry as they are misinformed – has pledged to vote down the budget, no matter what it is, just because.

It helps to understand how these districts determine their levy. Sales taxes are set at a fixed rate; school taxes aren’t. The district proposes a budget, which includes amounts to fund all its personnel and essential programs. Each district has different priorities. If the school district finds that it needs more money than it did last year, – even if it’s just to keep up with inflation – it has to ask for an increase in the total tax levy. That levy is then apportioned to taxpayers based on the value of their real property. So, if the overall levy goes up 2%, but your property value rises by 4%, your tax “rate” will go down. For towns like Clarence, whose property tax cap is higher, in part, due to its “growth factor” of 1.5, if the total property value added in the district via new construction in a given year outpaces the levy increase, your actual tax bill will go down. The district doesn’t raise taxes every year. The levy might go up, but how that translates to your personal tax bill varies. That’s before we get to the passage of the veteran’s exemption, enhanced STAR, agricultural exemptions, and other programs that lower the tax or assessed value for some taxpayers, increasing the burden on others.

This year’s fight began just after the Clarence High School production of Pirates of Penzance closed its three-performance run. Dedicated and talented kids – with the help from their faculty advisers – put on a Broadway-caliber show that was absolutely world class. Everyone from the amazing pit orchestra, to the tech crew, to the cast itself worked hard for months to pull it off. It wasn’t just some accident of talent. It’s how that talent is nurtured, developed, and grown. It starts with the music programs in the elementary schools, to instrument instruction, to singing, and then is further enhanced by the bands, orchestra, chorus, plays, and musicals that are done at the middle school. By the time these kids get to high school, those who are dedicated to drama, music, tech, and singing are well on their way to becoming professionals. It’s simply an amazing progression to watch, and the Clarence High School’s annual musical productions are absolutely incredible; a testament not only to talent, but to teaching.

But the people complaining about paying the second-lowest tax rate for the third-best school district in WNY didn’t see that performance, or any of that value. They don’t know about the successes in the engineering curriculum, or the fact that our system is one of the best in the country for music education, or that our mock trial team won a countywide competition. Despite the fact that the levy has only been rising since 2011, that is “far too long”, and they presented their first argument: restore local control and kick Albany to the curb. But that gap elimination de-funding hamstrung districts – the tax cap ensured that they had no way to even ask local taxpayers to make up that difference. In Clarence’s case, it was made through cuts, dipping into the fund balance, and through modest increases in the local school tax. Since 2011, the district cut 113 full-time positions.

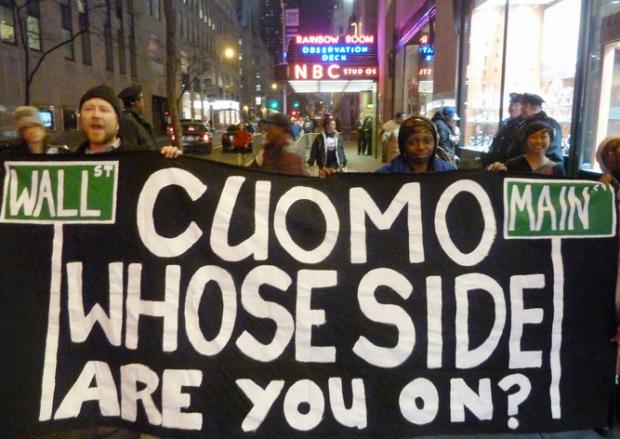

But these anti-tax warriors are playing people. In their public pronouncements, they say they want to maintain school quality, but when their words aren’t being recorded for posterity, or they’re speaking amongst themselves, they clearly intend to manufacture a crisis that would require the schools to effectively wither and die. Otherwise, they’d attend regular school board meetings and offer ideas. They’d know about the very strongly-worded letter that Superintendent Geoff Hicks sent to Governor Cuomo. They’d use the district’s legislative advocacy page. They’d show up.

Disapproval of a within-cap levy increase would do to the schools what 2013 did, and force students out of programs, eliminate teachers, close electives, and do palpable and real harm to students and their educations. For what? What is the underlying complaint here? Cui bono?

It doesn’t make any sense. After all, when the tax rate inched up last year, every taxpayer received a rebate check for the exact amount of the increase – mine was $71, and I donated it to the Clarence School Enrichment Foundation. The same thing will happen with this budget, if any increase is at or below the cap. The cap, for the record, is 4.7% because the town continues to grow, and because the district refinanced some existing debt at a lower rate, saving $4 million over the life of the note, and the new payments kick in this year.

So, in the face of all these excellent results and efficient, frugal management, we’re left with one argument: the teachers make too much. They’re greedy. They get summers off. They work short days. They get fat pensions and pay only 10% of their health insurance costs.

We hear a lot from tax opponents about “running government like a business”. Of course, schools don’t exist to make money – they exist to educate children. The output in Clarence is excellent. If you ran a multi-million dollar corporation, and when annual review came along, almost 85% of your key employees were exceeding expectations, you wouldn’t cut their pay and benefits, you’d give them a damn bonus. If you wanted to attract and retain this kind of talent, you need to pay them a living wage. So, are these mostly “highly effective” teachers overpaid?

I had someone argue to me that teachers don’t live in the “real world”. That’s completely wrong. Everyone’s “real world” is a bit different. Most New York teachers, unlike most of us in the “real world”, hold masters degrees. They must be tested, vetted, and authorized – licensed and certified – to teach. They are ad hoc social workers, mandated reporters, emergency caregivers, mediators, peacemakers, peacekeepers, role models, safe havens, and that’s before you get to the actual teaching part. As for teaching, they don’t just have to deal with ever-increasing class sizes, but also with administrators, parents, the state, and bureaucracy. They don’t make as much money as their peers with M.A.s or M.S.s in the private sector, and many of them take pay cuts to work in Clarence, which is by no means the district with the largest salaries in WNY for teaching professionals; Clarence is 13th for teacher pay. Sure, they get better health insurance and retirement than most people in the private sector, but that’s really an indictment not of the teachers, but of the private sector and the way it has stripped workers of pay and benefits over time.

It’s also comparing apples to oranges. Public sector workers go to work to serve the public, oftentimes at wages that would be embarrassing in the private sector. Consider, for instance, why it’s tough to find a CPA to run for comptroller. So, the public sector makes up for that by offering good benefits, usually negotiated through collective bargaining. So, is public service the “real world”? You don’t hear a lot of people whining about Chris Collins’ congressional salary, or that of his staff. Or Mike Ranzenhofer or Jane Corwin – no one bats an eye. No one much cares that the Clarence supervisor gave himself a couple of nice raises over the past few years. What is the “real world”? Why do teachers get this sort of scrutiny, but other public employees don’t?

If the real world of teaching in New York public schools was the bonanza of wine, song, and riches that some imagine, then everyone would be clamoring to join this profession. But for some reason they don’t. Maybe some people see the private sector as offering more opportunities for personal enrichment – after all, private sector salaries have no upper limit. Teachers on average make about $50-60k in Clarence, and that’s after at least a decade of service. It’s a nice paycheck, but none of them are getting rich. People complain that their benefits package can’t match what a teacher earns (note that word “earns”), but that’s the real world. Isn’t a good education part of the American dream? Don’t we want properly and adequately to remunerate the professionals upon whom Americans rely to educate our children?

Teachers aren’t paid during the summer. Their workday is not nearly as short as the kids’; it doesn’t begin and end when the bell rings – they have to attend conferences, plan their curriculum, grade papers, draft tests and course materials, and deal with all manner of after-hours parent or student issues. They’re not entitled to retirement benefits until they’ve worked in the district for 10 years. The teachers’ contract is online. An entry-level teacher with a master’s degree earns an annual salary of $41,400 at Step 1. That doesn’t break $50,000 until Step 9. You break $60,000 at Step 13, and $70,000 at Step 16. The max is $93,000 at Step 20. Some teachers receive stipends for extracurricular work, bumping veteran teachers up into the very low 6-figures.

Is $93,000 for a teaching professional with a master’s degree and 20+ years of experience excessive? Or are these wages firmly middle class? Clarence’s median income is $68,000. No one’s getting rich from a $90,000 annual income. No one’s driving a Bentley or smoking Cohibas in West Palm on that salary. Teachers give up the private sector, where financial risk and reward are both higher, in order to educate the next generation, and do so with some modicum of job and retirement security. There are few professions more important or noble, yet we continually demonize them as the root of the problem.

It’s a lot of money, but do they not earn and deserve it? How is their labor not incredibly valuable? I’m not saying their salary and benefits are cheap – they’re just earned. One of the leaders of the current anti-school effort in Clarence has a school tax bill that is, in 2014, a full 32% lower than it was in 2006. In real dollars. But she’s upset about sustainability?

The school board held a budget information session on March 30th. There, Superintendent Hicks outlined a revised proposal that would take into account estimates of increase state aid to raise the levy by 3.9% – significantly lower than the 4.7% tax cap, and restore 4 positions. In the meantime, since the state budget came out, it looks like we may see restoration of as many as 10 positions at that 3.9% figure. It’s a prudent measure designed to placate anti-tax members of the board, and also the parent-taxpayers who are demanding smaller class sizes, restored programs, and easing the burden on remaining teachers. It was a lively meeting, with a good debate. A few students came and spoke. Two teachers spoke. Two. Everyone else was either a parent-taxpayer or an anti-school activist.

The head of this year’s “no” posse sent a note to her listserv about that budget meeting and it was filled with either lies or emotion.

She was moaning about how “defeated” she felt because she was so outnumbered. Her crew was indeed outnumbered, but not by teachers or their union, but instead by concerned taxpayer-parents. We moved to that town because the schools are good and the taxes are lower than, say, Williamsville or Orchard Park. It’s a pretty sweet equation that few other places are able to replicate. But the gutting of teachers and programs in 2013 wasn’t good enough – the school opponents are now out for blood. They’ve moved the goalposts – 4.7% is too high, 3.9% is too high, indeed anything greater than 0% is too high. Their arguments go back and forth like a pinball from “state control” to “teachers are paid too much” to “union contract”. The people demonizing teachers argue that, in addition to making too much, they enjoy tenure and cannot be fired. Tell it to the many Clarence teachers who have been let go since 2011.

According to her email, one of the two school board members the anti-tax crowd perceives as friendly wrote to them, “Don’t give up – that’s what they want. Keep up the good work. You guys showing up last night was important because it balances out the teacher influence. Keep the troops organized and keep coming to the meetings. thank you for what you do – it makes a difference.”

That was written by a school trustee who owes a fiduciary duty to maintain the excellence of the school system in a way that is respectful to all taxpayers. I don’t know what “teacher influence” was extant at that meeting, as only two teachers spoke. The “difference” being made is that the board could choose to raise the levy by 4.7% and restore even more positions, but won’t. Is that refusal to right the wrongs of the past few years in the district’s best interests? Are the students’ needs being met?

What I do know is this: parents will agitate for the levy to go up to the cap, and for the restoration of teachers, social workers, and electives. The “no” crowd doesn’t get to control or monopolize the agenda. What is there to lose? The anti-school people will vote “no”, regardless; they will vote no for 4.7%, and they will vote no for 3.9% and they would vote no if the increase in the levy was 0.01%. The parents, by contrast, are likely open to compromise.

So, it’s only a matter of time before this sort of nonsense happens in every school district. Demonization of teachers, de-funding of schools, privatization, and the further erosion of the middle-class American dream. Not just demanding that teachers be at-will grunts who earn McDonald’s wages, but that parents and students be subjected to substandard public schools, leading to de-funding, vouchers, or straight tuition.

They say that private schools do it better and more efficiently. My tax bill is about $4,400, and that pays for two kids’ educations. That’s a bargain, and one of the most important taxes I pay, and I pay it gladly. Our future depends on it.

It will continue to be thus when they graduate, because all town kids deserve the same shot that mine got, if not better.

Please get active in your school board. Take an interest in what’s going on – whether you have kids or not, but especially if you do. Apathy is the ally of malevolence, and you can help ensure that the people you elect do the right thing.